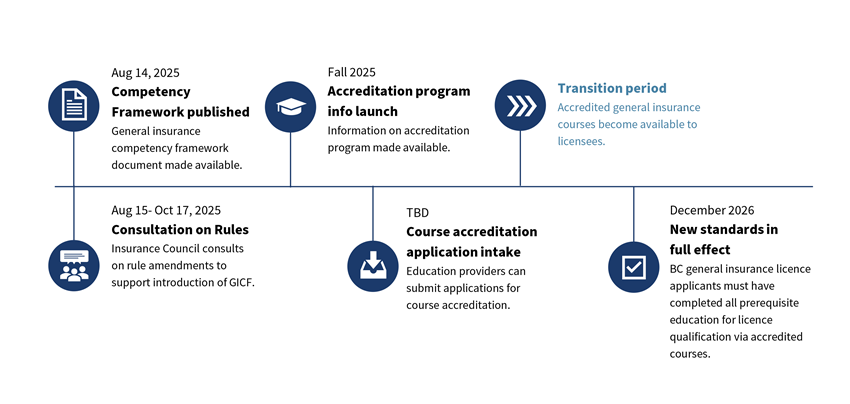

What's happening and when

Introduction of framework and Rule amendments – We have released a program handbook to provide information about the General Insurance Competency Framework to licensees, education providers and other stakeholders.

From August 15-October 17, 2025, the Insurance Council will be

consulting on rule amendments* to support the implementation of the general insurance competency framework and an accreditation program for general insurance education. *

(link will be live as of Aug 15)

Accreditation program begins – Pending rule approval by government, we are targeting Fall 2025 to provide detailed information about the Accreditation Program for General Insurance intended for third-party education providers, including how to apply for course accreditation and evaluation criteria. This will then be followed by the intake of applications for accreditation.

Transition to new licence qualification standards – There will be a period of transition as accredited general insurance courses become readily available. After that, starting in December 2026, new applicants and licensees applying for a new licence or a licence upgrade will need to have met their education requirements for licensure with accredited courses.